FAMILY DOLLAR | ATLANTA , GEORGIA

INVESTMENT SUMMARY

Purchase Price

$2,412,818

Location

226 Ralph David Abernathy Blvd

Cap Rate

5.75%

Annual Rent

$138,737.04

Building Size

8,000 SF

Land Area

0.91 Acres

Ownership

Fee Simple

Lease Type

Absolute NNN

Term Remainning

8 Years

LEASE EXPIRATION

06/30/2029

Renewal Options

RENT INCREASES

CPI Every 3 Years (6% Max)

Parking

27 Spaces

Year Built

2015

APN

14-0075-0001-158-6

Traffic Counts

10,604 VPD

INVESTMENT HIGHLIGHTS

FAMILY DOLLAR LEASE:

- Approximately 8.25 Years Remaining in the Initial 15 Year Lease Term

- 2015 Construction - 8,000 SF

- Six (6) - Five (5) Year Option Periods

- Upgraded Brick Construction

A TRUE COUPON CLIPPER | ABSOLUTE NNN LEASE:

- Absolute NNN Lease with ZERO Management Responsibilities

- Tenant Pays for ALL Operating Expenses, Insurance & Property Taxes

RARE LEASE STRUCTURE - RENT INCREASES EVERY 3 YEARS:

- CPI-Based Rental Increases Every 3 Years During Initial Lease Term and Option Periods

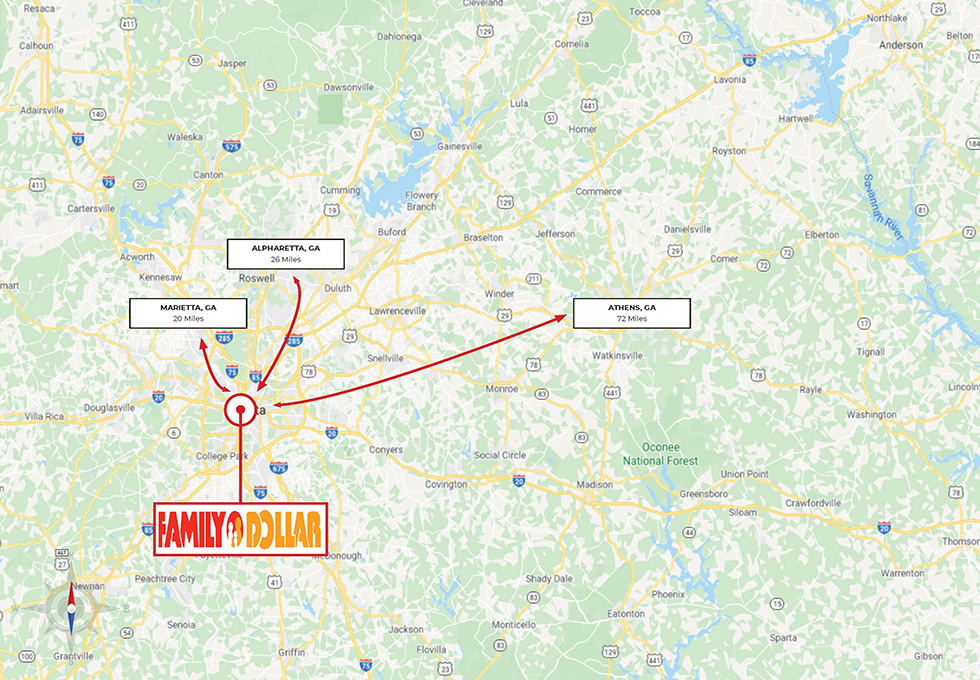

PROXIMITY TO OTHER MAJOR CITIES:

- Marietta, Georgia | 20 Miles

- Alpharetta, Georgia | 26 Miles

- Athens, Georgia | 72 Miles

- Columbus, Georgia | 107 Miles

- Chattanooga, Tennessee | 118 Miles

- Charlotte, North Carolina | 245 Miles

TRADE AREA DEMOGRAPHICS:

- 1-Mile Population = 17,974 Residents

- 1-Mile Average Household Income = $54,978

- 1-Mile Annual Population Growth = 2.57% (12.85% Over the Next 5 Years)

- 3-Mile Population = 161,680 Residents

- 3-Mile Average Household Income = $79,313

- 3-Mile Annual Population Growth = 2.07% (10.35% Over the Next 5 Years)

- 5-Mile Population = 347,512 Residents

- 5-Mile Average Household Income = $93,063

- 5-Mile Annual Population Growth = 1.91% (9.55% Over the Next 5 Years)

TENANT:

- Dollar Tree, Inc. (NASDAQ: DLTR) Features Investment Grade Credit (BBB) by Standard & Poor's

- 15,685 Stores Across 48 States and Five Canadian Provinces as of December 31, 2020

- Ranked #131 on Fortune 500 List

CREDIT RATING UPGRADE - DECEMBER 2020:

- Standard & Poor's Recently Upgraded Dollar Tree's Credit Rating to BBB

- Standard & Poor's Credits the Upgrade to Dollar Tree's Resilient Performance Throughout 2020's Government-Imposed Shutdowns, its Aggressive Debt Reduction Since Acquiring Family Dollar in 2015, and its Ongoing Store Renovations and Merchandising Improvements